Initiative in Sustainable Finance: Insurers’ Carbon Underwriting Policies

Research Highlight by Olimpia Carradori, Felix von Meyerinck and Zacharias Sautner

Context

Insurance companies may influence the transition to net-zero emissions by restricting insurance coverage of carbon-intensive projects. As the costs and risks associated with climate change mount, insurers are under increasing pressure to adopt such “carbon underwriting policies”. Yet, their design, implementation, and real-world effects remain largely unstudied—until now.

Research Question

The study investigates the determinants and structure of carbon underwriting policies among the world’s largest insurers, how these policies are implemented, and whether these policies influence the operations of carbon-intensive projects, particularly U.S. coal mines. Specifically, it asks: Do carbon underwriting policies reduce insurance coverage for such projects—and if so, does that reduction constrain their operations and support decarbonization?

Data & Methodology

The analysis is based on several novel data sources:

- Standardized scorecards from Insure Our Future (IOF), an NGO coalition, that measure the prevalence and stringency of carbon underwriting policies among the world’s largest property & casualty insurers.

- Insurance certificates for U.S. coal mines obtained via Freedom of Information Act (FOIA) requests, which reveal which insurers provide coverage to which U.S. coal mines over time.

- Granular mine-level data from the Mine Safety and Health Administration (MSHA) on production, employment, and operational status.

By linking these datasets, the authors identify which insurers adopt carbon policies, track changes in insurance coverage around policy adoptions, and compare operational outcomes between affected and unaffected mines. These data allow for the first systematic assessment of both policy implementation and real-world effects.

Key Findings

Policy Adoption:

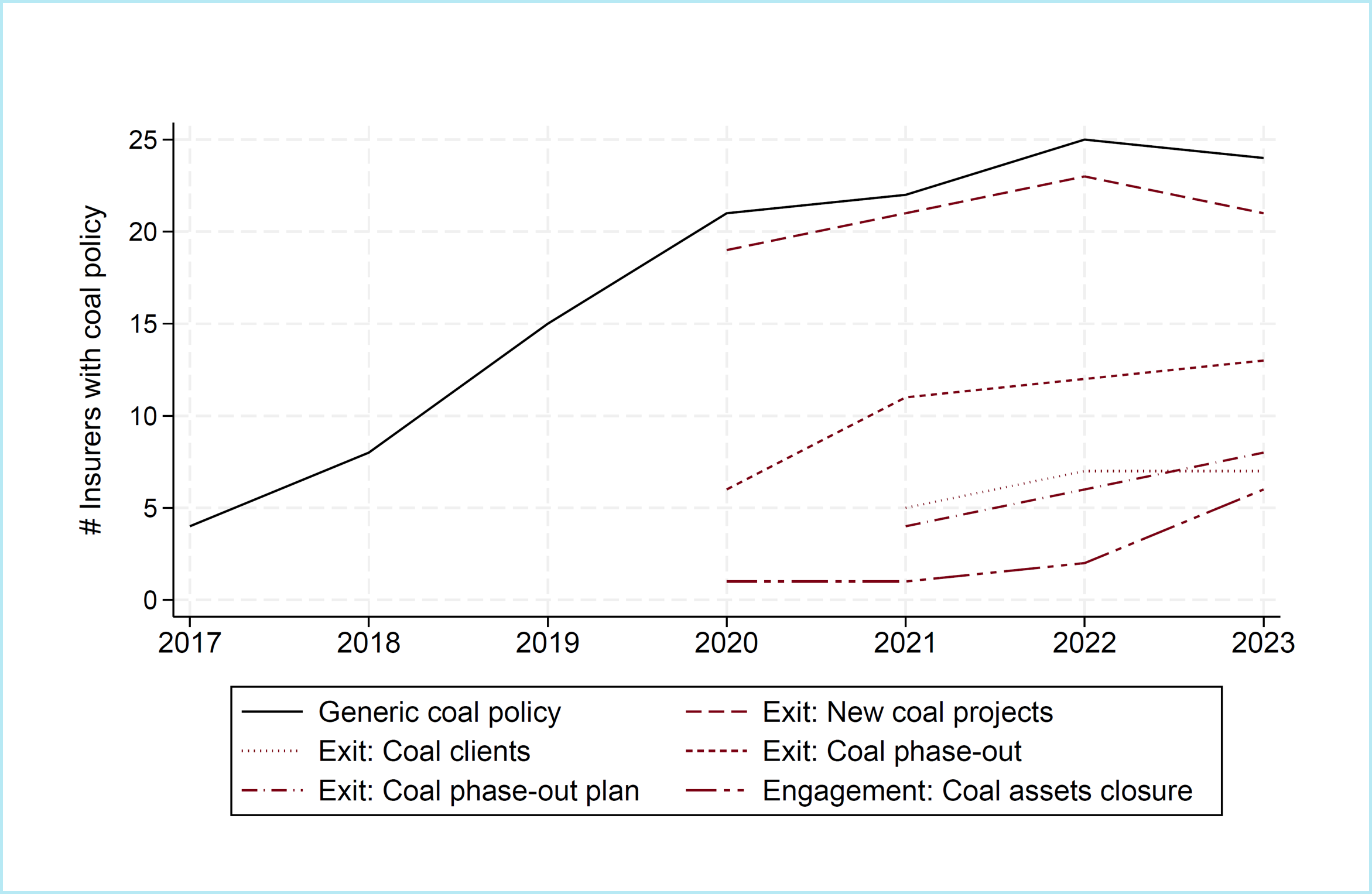

Figure 1 presents the prevalence of coal underwriting policies over time. The solid line indicates that coal underwriting policies become more common and stringent since 2017. By 2023, 80% of insurers included in the scorecards have coal policies. A minority includes comprehensive phase-out strategies. Oil & gas policies (not reported in the figure) remain less prevalent and generally weaker.

Figure 1: Coal Underwriting Policies over Time

Effects on Insurance Coverage:

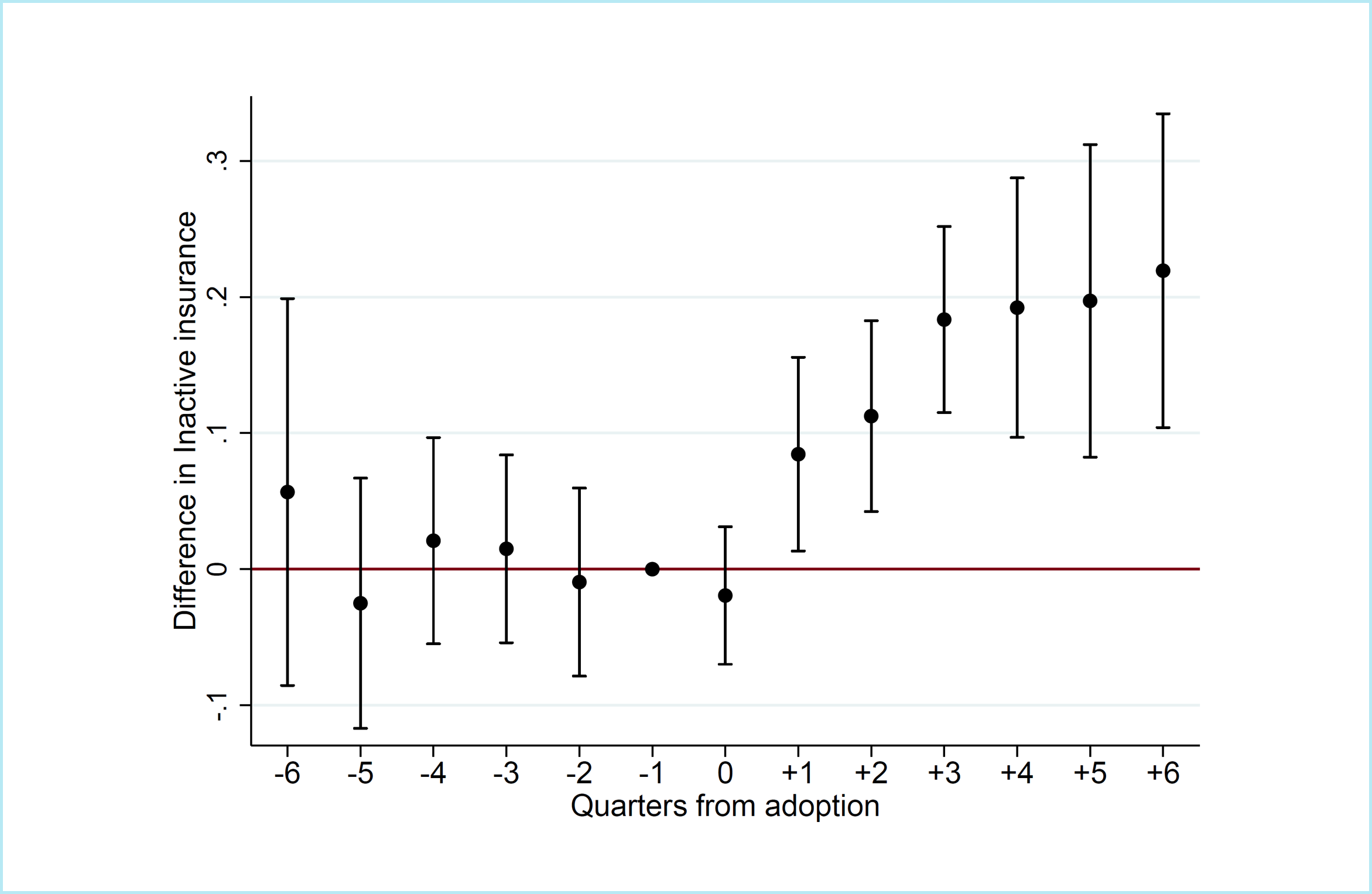

The study documents that carbon policies drive changes in underwriting activity, suggesting that at least some insurers begin to implement their policies upon introduction. Figure 2 presents changes in the likelihood that an insurance relationship between a U.S. coal mine and an insurer becomes inactive.

The study exploits that mines obtain coverage by multiple insurers at a given point in time, allowing for a comparison of how different insurers adjust coverage for the same mine around policy adoptions. Starting in the first quarter after the adoption of a coal policy, relationships between mines and policy-adopting insurers are significantly more likely to be inactive. This likelihood increases steadily, from 8.4 percentage points in the first quarter to 18.3 percentage points by the fourth quarter. The study also finds that such effects are stronger for insurers with more stringent policies and vary by insurance type (e.g., worker safety coverage is more likely to be retained). At the insurer level, these findings aggregate to reductions of the total number of insured mines by 16% and insured coal volumes by 56%.

Figure 2: Effects of Coal Underwriting Policies on Insurance Coverage

Effects on Mine Operations:

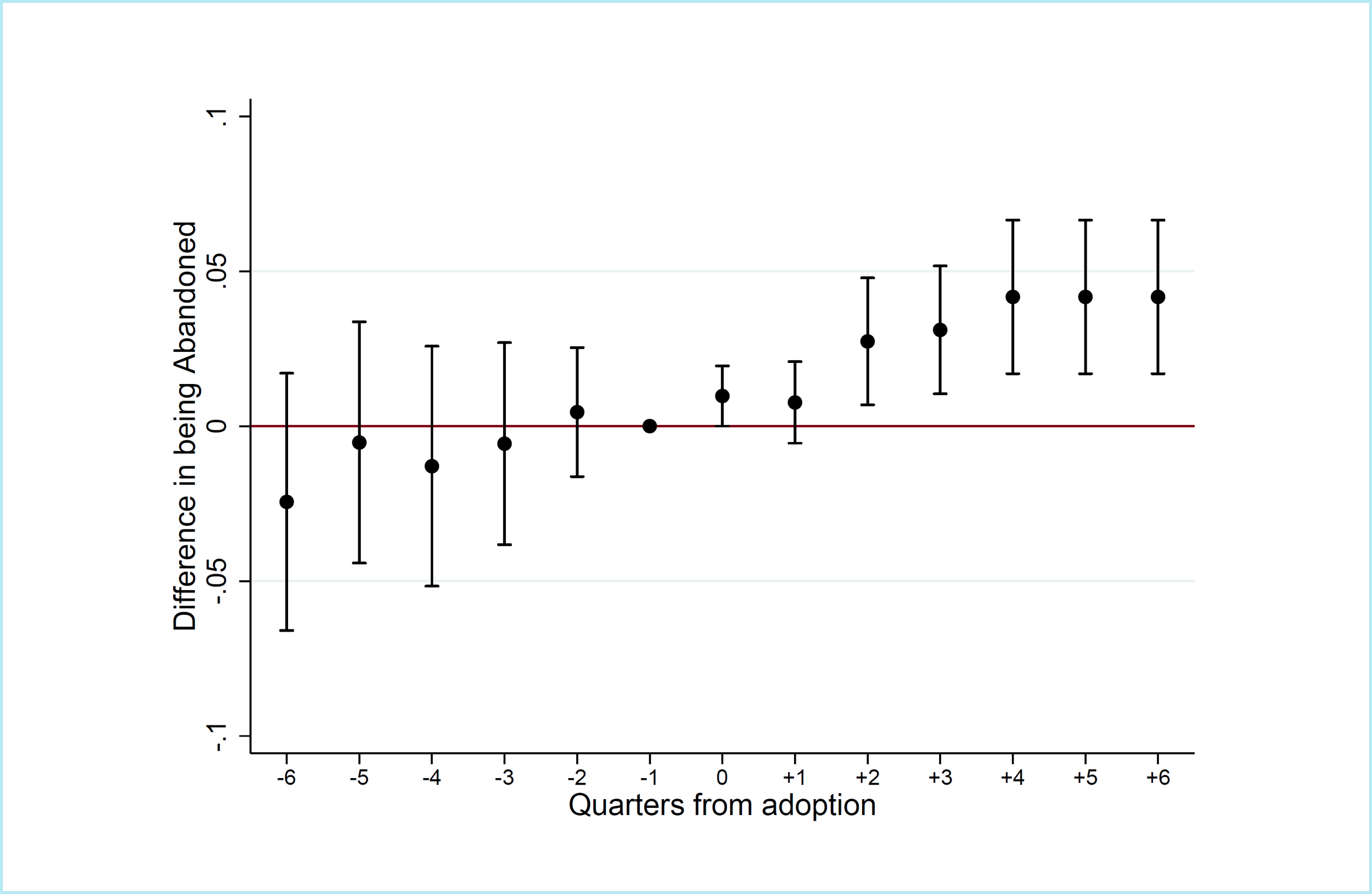

The study also finds evidence that underwriting decisions by insurers have real effects on the operations of insured projects. Figure 3 compares the likelihood that a mine becomes abandoned around policy adoption. There is a significant and sustained increase in the likelihood that a mine is abandoned following policy adoption, beginning in the second post-adoption quarter. This difference increases to almost five percentage points, again leveling off in the fourth post-adoption quarter. These effects are more pronounced for mines that rely heavily on fewer insurers. Employment and production also decline.

Figure 3: Effects of Coal Underwriting Policies on Mine Operations

Relevance

This study provides the first systematic evidence that insurers’ carbon underwriting policies can directly constrain carbon-intensive operations. However, the impact of these policies hinges on the policy design, stringency, and actual implementation. The authors call for greater transparency in underwriting practices and public disclosure of insured exposures to enable more robust assessments and to extend these insights to other sectors beyond coal, including oil and gas.

To learn more, explore the full working paper (SSRN) or get in touch with the authors.

Photo source: Patrick Hendry via Unsplash

Initiative in Sustainable Finance News