A conversation about sustainable finance, bridging research and practice, and "100 Women in Finance"

Interview with Anjeza Kadilli, Academic Guest at our UZH Department of Finance

Anjeza Kadilli is Associate Professor of Finance at the International Business Management Department of Haute Ecole de Gestion (HEG) in Geneva, part of the University of Applied Sciences of Western Switzerland (HES-SO). She is also the Co-director of the Certificate of Advanced Studies in Sustainable Finance at HEG Geneva. She very much likes acting bridging the gap between academic research and practical applications.

Interview

Dear Anjeza, you are an Academic Guest at the UZH Department of Finance. What motivated you to choose UZH and our department for your academic research?

I have known the Department of Finance at the University of Zurich since my time as a student at the University of Geneva. In particular, I took a course during my Master's degree taught by a professor from the Department of Finance at the University of Zurich who was visiting the University of Geneva. It turned out to be one of the most valuable parts of my degree. During my PhD, I regularly read the research conducted at the Department of Finance. I continued to do so in my professional life in the banking sector. When I returned to academia, I started attending the department's research seminars, which inspired my own research. Apart from academic excellence, I also highly value the department's connections with the private sector, as well as with local and international organizations.

Could you briefly describe your main research interests and explain what motivated you to pursue this focus?

My research interests are wide-ranging and include macrofinance, international finance, sustainable finance, risk management and quantitative methods. These interests reflect my background, which ranges from a PhD in econometrics, to working as a dedicated macroeconomist in the banking sector, to becoming a Professor of Finance. A common thread runs through all my research: an understanding of global phenomena. Financial markets play a crucial role as a funding vehicle, which is why I place them at the center of my research agenda. Some of my research highlights include the relationship between income inequality and financial market performance and modelling extreme events in bond markets. I am currently leading a three-year research project, funded by the Swiss National Science Foundation (SNSF), which examines the impact of sustainability regulation on financial markets.

Your research spans macro-economics, international finance, risk modelling and sustainable finance. What was the key turning point or experience that led you to integrate sustainability into quantitative economic and financial modelling?

Sustainability came very naturally to me. In my previous job in banking, I assessed country risk using various economic and governance indicators. The concept of sustainability gradually became part of these indicators as the institution I was working for sought to gain knowledge on sustainable investment and the impact of its funds on the economy. The transition to a more sustainable economy requires us to put a price on externalities. This is an area in which economists can play a role, which is why I am continuing my research in sustainability, building on increasingly rich data and more sophisticated quantitative methods.

As Co-Director of the Certificate of Advanced Studies in Sustainable Finance at Haute École de Gestion – Genève, you engage both with students and industry practitioners. What do you perceive as the greatest gap between academic research and practice in sustainable finance today, and how are you trying to bridge it?

In the current sustainability transition, education is crucial. Financial sector practitioners urgently need to improve their knowledge of sustainable finance to make the right investment decisions, respond to regulatory changes, and meet the needs of their clients. Through our executive training programs, we aim to address this issue by providing practical knowledge based on scientific evidence. Looking to the future, the financial sector should invest more in sustainability education for professionals. Academic institutions, including HEG, are better preparing future generations by integrating sustainability education from bachelor's level.

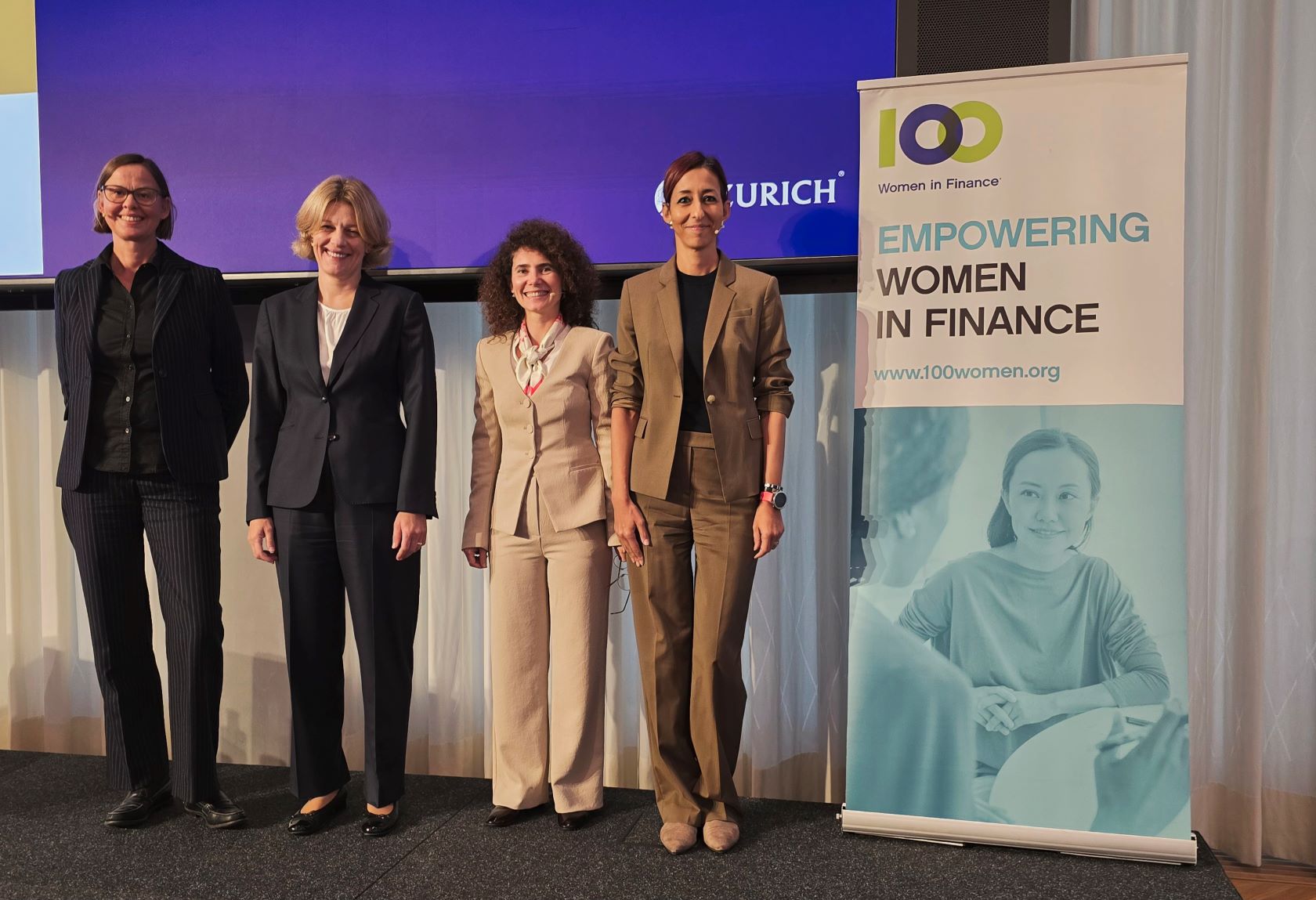

You are a committee member of 100 Women in Finance in Zurich. We met are The Economy and Swiss Monetary Policy Event (https://100women.org/events/) where you were a panel session speaker. I have two questions with regard to that event: Can you please share our thoughts about the role of women in finance and why you are engaged in this very interesting group. At this very event we heard and learned a lot about the current situation with regard to the economy and the Swiss way of handling challenges and opportunities. One question came about Sustainable Finance impact and ESG fatigue. What is your view on this timely topic?

Women make up half of society, so their role in finance and other fields should be proportionate. The financial sector is making some progress, which I think will be accelerated by a shortage of talent and an ageing population. This should be particularly evident in Switzerland, where women are highly educated. 100 Women in Finance is a large international organization with over 30,000 members in 32 locations. It provides a platform for women and financial professionals to discuss topical issues and broaden their network. I have been a volunteering member of the Zurich Committee since 2022, which has been a highly empowering experience. I in particular encourage students to become members for free and attend events in Zurich and abroad.

At the latest event that I organized, Dr. Petra Tschudin, a member of the Governing Board of the Swiss National Bank (and member of the Advisory Board of the UZH Department of Finance), gave a talk on Swiss monetary policy and economic activity. During the panel discussion, I was asked about ESG fatigue. This can be partly explained by other geopolitical events and the need for international cooperation to successfully address this issue. However, I believe that the transition to sustainability is not optional, but a requirement if we are to build resilience, including within the financial industry.

Your consulting work has included diverse mandates — for example, assessing the impact of carbon tax in Mongolia, or benchmarking digital private-banking practices in Switzerland and Liechtenstein. From those engagements, what unexpected insight or challenge emerged that your academic research didn’t predict?

As part of my mission, I frequently collaborate with policymakers and the private sector. This enables me to draw on my dual academic and practical experience. One challenge is finding a common language and correctly pinpointing the topic from different perspectives. However, such collaborations provide valuable insights and lead to concrete actions. For example, the Bank of Mongolia could use the report we wrote together when discussing the country’s sustainability path with the Mongolian Presidency.

The large-scale survey of digital practices in private banks in Switzerland, the second edition of which will be published in early December, provides a reliable benchmark and encourages banks to accelerate their digital transformation. This a very pleasant part of my job.

- Summary of study: Digital benchmarking for Swiss and Liechtenstein private banking

Looking ahead: your project “The Impact of Sustainability Regulation on Investment” (funded by Swiss National Science Foundation) aims to explore structural breaks in returns and volatility due to regulation. In your view, which type of sustainability regulation (e.g., carbon pricing, disclosure regimes, taxonomy-based regulation) holds the greatest potential to create such structural change and why?

An optimal regulation should be straightforward to implement and avoid undesirable distortions. Research shows that carbon taxes are one of the most effective ways of reducing carbon emissions while minimizing undesirable effects. They generate revenue that can be distributed to those affected by the tax. However, they must be implemented gradually to allow the real economy to adapt, for example by developing better technologies. I am excited about the potential collaborations that are set to emerge from the SNSF academic project, which began last summer.

- SNSF project by Anjeza Kadilli: The Impact of Regulation on Sustainable Investment

Dear Anjeza, thank you very much for taking the time and your valuable insights! And I am looking forward to see you again at the next 100WF event! Alle the best for your future projects!

More information:

- 100 Women in Finance:https://100women.org/events/

- Swiss National Science Foundation (SNSF): https://www.snf.ch/en

SNSF Project: "The Impact of Regulation on Sustainable Investment" by Anjeza Kadilli: The Impact of Regulation on Sustainable Investment - Digital practices in private banks in Switzerland, Edition 2

Summary of study: Digital benchmarking for Swiss and Liechtenstein private banking

e.foresight (Swisscom's banking trend scout) conducted a study on digital customer interfaces in private banking in collaboration with the Haute école de gestion Genève (HEG; Prof. Anjeza Kadilli). This benchmarking study analyzes the current and future functionalities of 30 private banking players (private and universal banks) in Switzerland and Liechtenstein.

Cornelia Kegele