"Institutional Investors and the Fight Against Climate Change"

Review article by Thea Kolasa and Prof. Zacharias Sautner

Learn more about valuable insights on institutional investors and climate change in a review article by Thea Kolasa and Prof. Zacharias Sautner published as a Swiss Finance Institute Research Paper. Drawing on more than 50 articles and research papers, they examine the significant impact of climate change on institutional investors and their potential to influence corporate behavior towards sustainability.

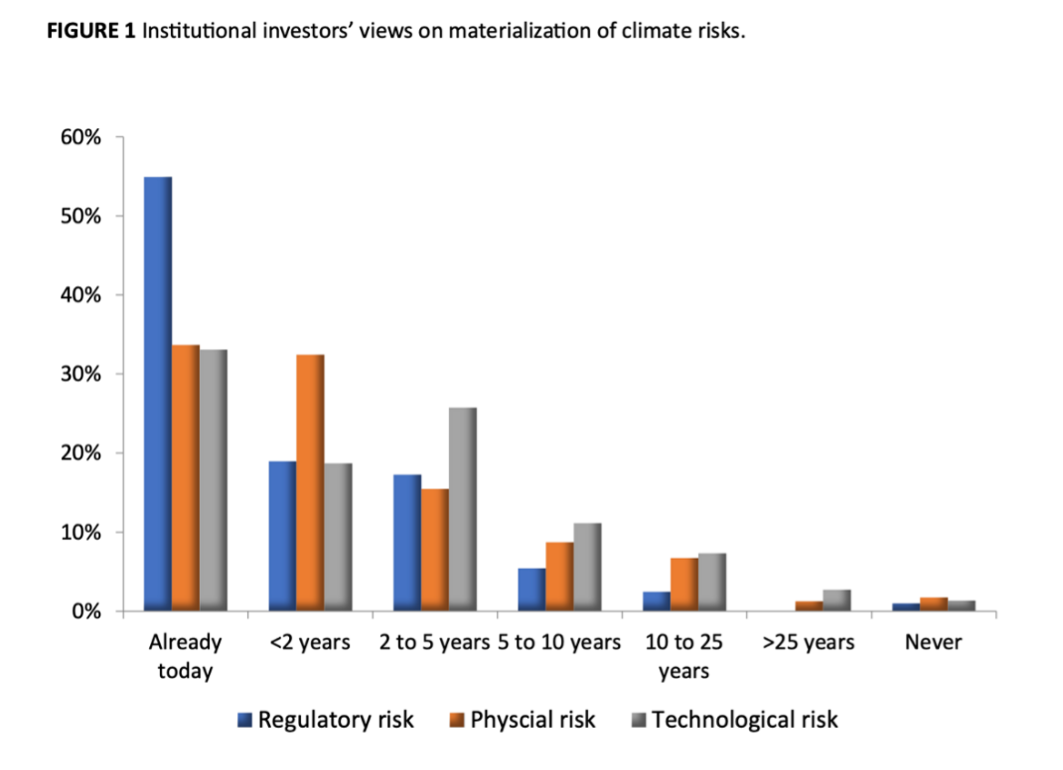

Climate change and the transition to a low-carbon economy pose significant risks to the assets managed by institutional investors. Regulatory risks, e.g. carbon taxes, cap-and-trade policies, bans on carbon emissions, technological shifts that threaten the existing business models of firms, and physical risks all contribute to a potential decline in asset values of investors' portfolio firms. Today, institutional investors see regulatory climate risks as the largest risk to materialize financially (Figure 1), followed by physical climate risks.

Incorporating climate risks

There is a growing trend in financial markets to incorporate climate risks into investment considerations. Recent literature shows that institutional investors can significantly influence environmental outcomes positively through various investment strategies and coalitions with portfolio firms. Initiatives like Climate Action 100+ have successfully pressured some of the largest carbon emitters to commit to substantial emissions reductions. Moreover, proactive engagement and climate-conscious investing strategies are leading to improved climate disclosures and practices among portfolio companies. This effect is observed across different groups of institutional investors, including those from countries with stewardship codes, those with climate-conscious societal norms, and universal owners with broad portfolios exposed to climate change.

Gap between commitment and actions

Although the evidence is encouraging, challenges remain. Many institutional investors are yet to take meaningful action against climate risks. As shown in the Climate Action 100+ target list, a considerable proportion has committed to achieve net zero emissions by 2050 across some or all of their emissions, but far fewer firms actually implement tangible actions to adjust their investment strategies in line with these commitments. Current data show that, there is an absence of a dominant approach to address these climate risks, implying that it is still unclear which methods are effective.

Regulatory frameworks primarily focus on disclosure requirements rather than specifying targets or actions to account for climate risks. This emphasis contributes to investors' uncertainty in effectively incorporating climate risk considerations into their strategies. Furthermore, the effectiveness of climate coalitions is threatened by legal and strategic challenges. Major institutions such as JP Morgan Asset Management and State Street Global Advisor recently announced a full or partial withdrawal from these coalitions, leading to concerns about the credibility and effectiveness of the collective engagement efforts.

Finally, heavy reliance on potentially unreliable ESG ratings also poses a major challenge in addressing climate risks. While ESG rating agencies play a crucial role in evaluating firms' ESG performance, most institutional investors lack the time, expertise, or resources to construct ESG or climate ratings for their portfolios. These issues underscore the need for more robust engagement and clearer regulatory guidelines.

Outlook

To understand the role of institutional investors in climate finance, more research is needed on the impact of ESG data reliability, greenwashing, and the effects of climate lobbying. Ensuring that climate-related data remain accessible and affordable for independent research is crucial for sustaining progress.

As we face one of the greatest global challenges of our time, the financial sector has both a pivotal role and a profound responsibility. Engaging with this topic is essential for anyone involved in finance, policy-making, or corporate governance.

Read the full paper here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4777844

Photo by Unsplash

Initiative in Sustainable Finance News